(9 Rules) How To Choose Stocks For Intraday Trading

Intraday Trading is a type of trading in which you buy & sell stocks on the same day. Choosing the best stocks for intraday trading one day before from more than 2,100 stocks listed in the NSE is a very time-consuming process.

If you can find good stocks that meet certain conditions, then those stocks are said to be golden in Intraday Trading by many experienced traders.

In this blog post, I am going to discuss 9 criteria or conditions that you should look at while choosing it for intraday.

To make your work even less & focus your maximum time on strategy-making, I am going to tell you smart tools that scan stocks that meet the mentioned conditions.

Table of Contents

10 Rules To Choose Stocks For Intraday Trading

Intraday trading is all about Choosing the right stocks with the proper strategy. Below are some conditions that an ideal intraday trader should look for in stock before including it in my intraday watchlist.

If you follow all the below rules then you can find the best opportunities for intraday in the chart as compared to taking random stock for intraday.

1) Identify Stocks With High Volume And High Relative Volume

The first Condition that every intraday trader should look for the stock to include in their intraday watchlist is stocks with high volume, especially stocks with high relative volume.

High Relative volume is the best indicator in intraday as it compares the current trading volume to its average volume over a certain duration. (Usually last 7 days for intraday trading)

High relative volume means that there is more buying & selling in the stock as compared to its usual buying & selling.

2) Stocks With High Liquidity

The second best indicator that I usually see in the stock while choosing it for intraday trading is the liquidity of the stocks.

More liquidity ensures the buying or selling of stock without affecting its price much. That is the most crucial factor while trading in the Intraday.

3) Stocks With Low Float Shares

The third condition I look at in the shares is stocks that have low float which means stocks that have few trades to buy & sell for the traders. (Around Less Than 25 Million).

When a company has a low float share, that means there are fewer shares available for trading. Because of fewer shares price goes much higher when demand increases as compared to those who have more shares to trade.

In simple words, low float causes big upward or downward moves in the market which is the best condition in intraday trading.

4) Stocks In The News Are Best For Intraday Trading

The prices of the shares are sensitive to the news in the market. When a company has good or bad news the share price moves accordingly.

The fourth condition every intraday trader should look for is if there is any news about the stock they’re trading and act accordingly.

Choosing intraday positions based on news is a smart strategy because it increases the likelihood of hitting targets. (Eg: Recent News Of Paytm, Hindenburg Report On Adani)

5) Find Leading Percentage Gainers & Losers (Top Gainers & losers)

The Fifth Rule is to find the leading percentage gainers & losers from the market such stocks help to identify the market momentum. You can keep an eye on such stocks as they have the potential for quick profit

When a stock is in a high percentage gainer list, it suggests positive upward momentum. We have to analyze such stocks and identify if there’s a chance to jump in and make money before it level off.

On the other hand, when a stock is in the top losers list, it’s a sign that there might be a chance to profit from a downward trend.

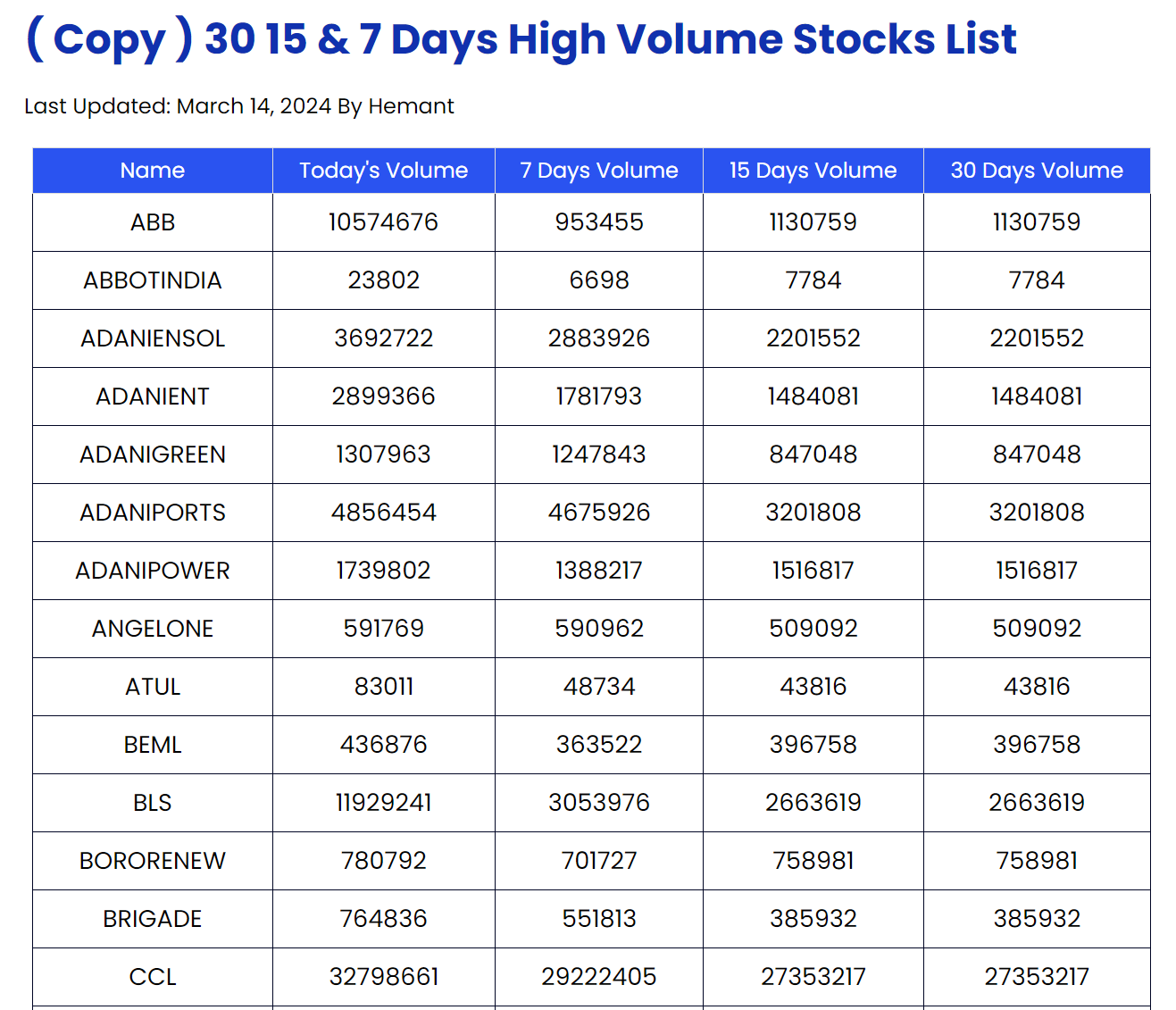

6) Stock Which Today’s Volume Is More Than 30, 15 & 7 Days Average Volume

The sixth condition is identifying stocks that have more volume today than last 30, 15 & 7 trading days. This condition indicated increased activity from traders.

This increased activity often leads to more significant price movements, presenting opportunities for intraday traders to profit.

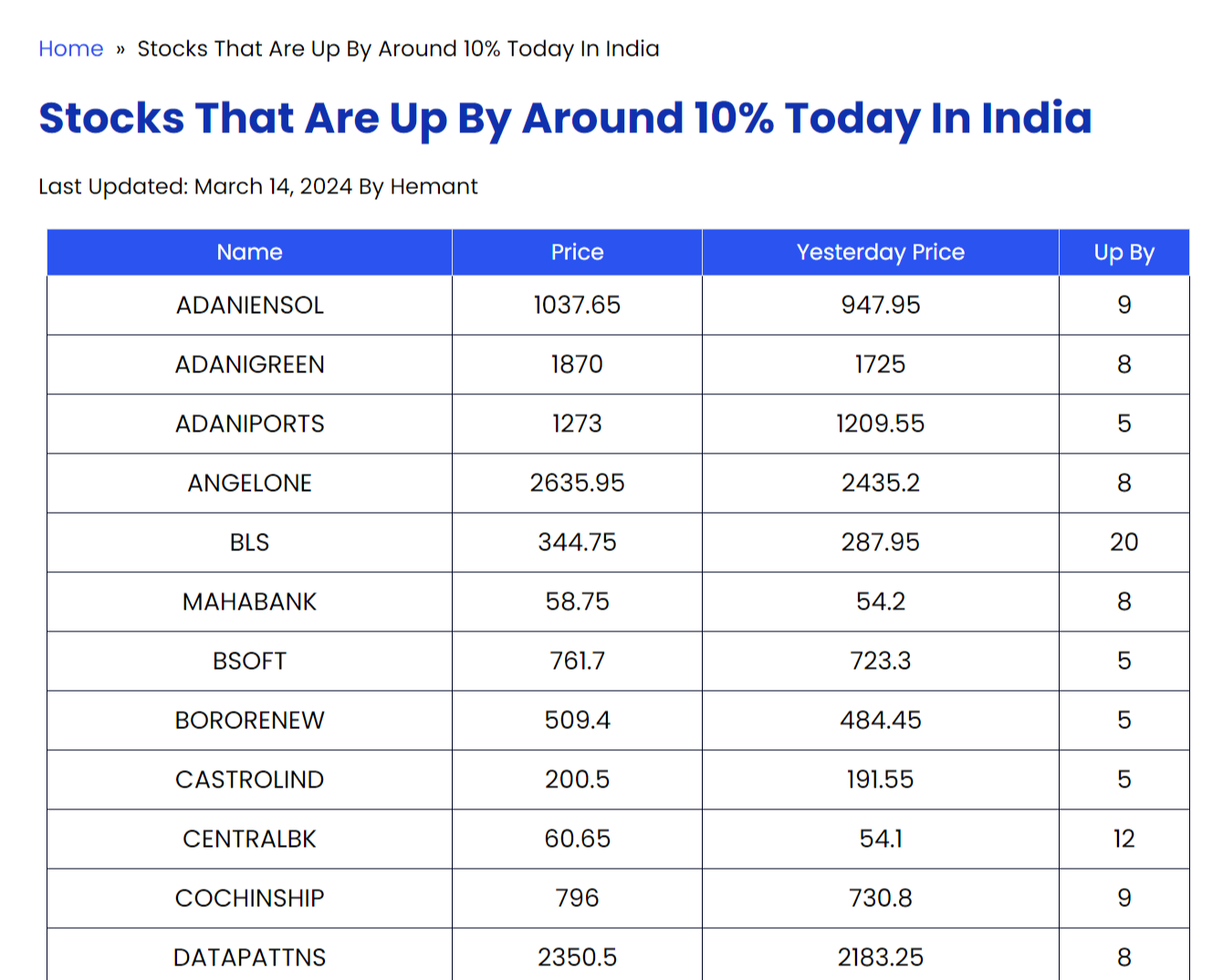

7) Stocks That Are Up By 10% Or More than 10%

The seventh condition that you should look in the stocks for intraday is stocks that are up by 10 or more than 10%.

Stock that is up by 10% indicates that something significant is happening in India (Positive, Negative News, or breakout).

Such effective moments in the stocks attract more traders & investors which can create good opportunities for intraday trading.

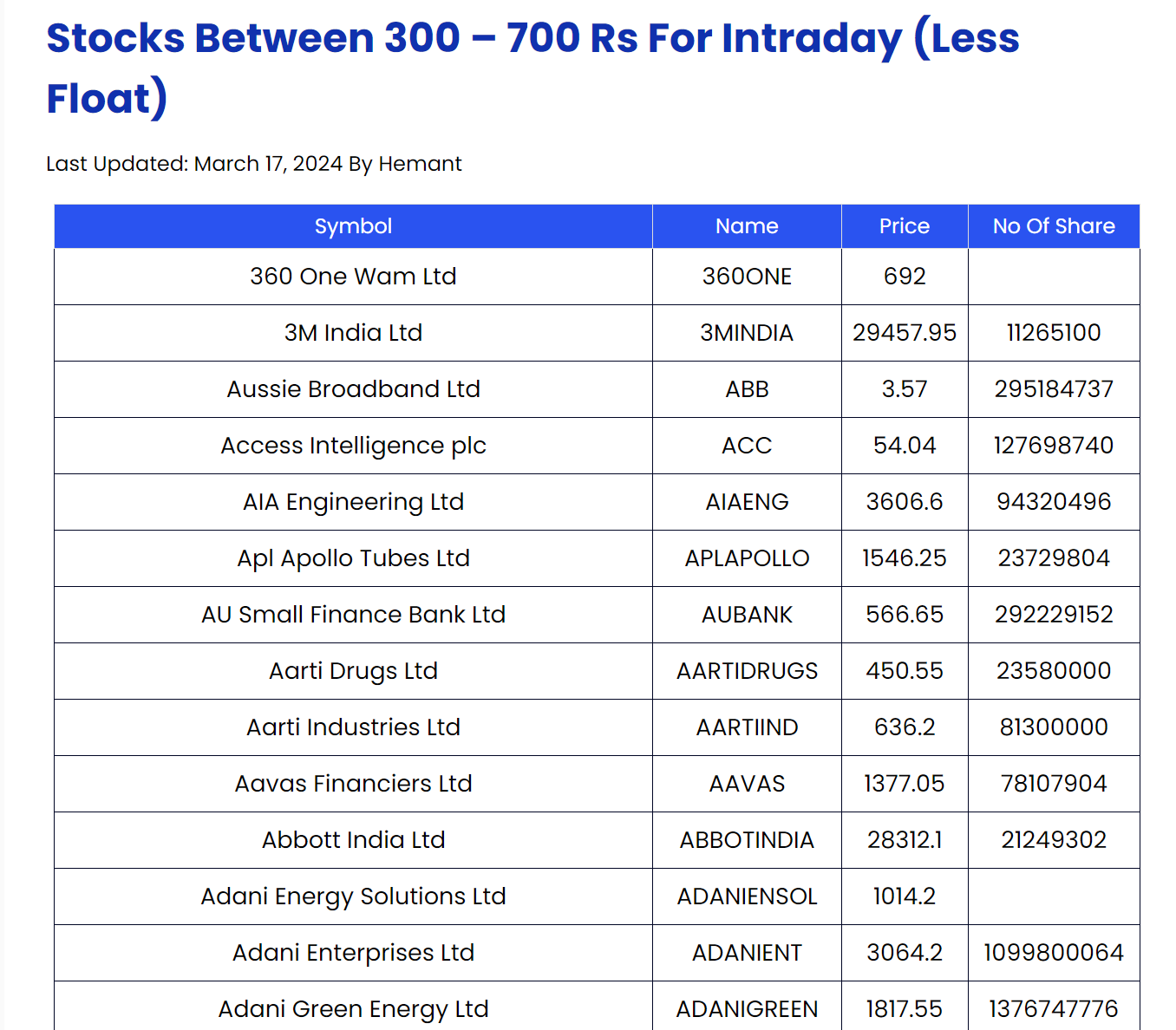

8) Stocks Between Rs 300 & 700 Rs

The Eight conditions that you should look for in stocks is whether they are in a certain range, especially between 300-700.

Stocks which has prices between 300-700 are considered best for intraday trading as they are not too expensive & not too cheap.

Filtering stocks between 300-700 can be helpful to make more informed decisions & risk management.

9) Stocks Showing Similar Trends As Of Their Sector

The ninth rule when selecting stocks for intraday trading is to filter stocks that are showing similar trends as those of their sector.

Stocks showing similar trends as of their sector indicated that the movement that is happening in the stock is not isolated (not happening due to another reason). & tells the movement is broader patterns within the entire sector.

Because of this condition, the success rate of your trades increases & you can make precious strategies.

But For Beginners, it is difficult & time is taken to check all the above rules one day before. So Now will see how we can be more productive by finding stocks that follow all the above rules.

How do I find intraday stocks one day before?

Choosing ideal stocks for intraday trading is much easier because of online screeners as I am going to mention below. You have to visit these screeners & copy the stock names

1) How To Find Gap Up Stocks For Intraday Trading One Day Before?

To find a list of gap-up stocks for intraday Trading one day before you can visit our gap-up stocks page & copy the list of gaps up. Such stocks are helpful for gap-up strategies which is best & effective for beginner traders.

2) How To Find Stock That Has More Volume Than 30, 15 & 7 Days

Similar To Getting gap up stocks list you can find stocks that have more volume today than the previous 30, 15 & 7 days.

To get a list of such stocks for intraday trading you can go to high-volume (Relative) stocks on the intraday page. You will get a list of such stocks shown in the following image:

3) How To Find Stocks That Are Up By 10% For Intraday Trading

To find the daily stocks for intraday trading that are up by 10% for intraday you can go to our page which filters down the stocks that are up by 10% to take long for intraday.

4) How To Find Stocks Between 300 – 700 Rs For Intraday Trading

To get the stocks for intraday trading whose price is between 300 – 700 Rs you can go to our page that filters down the shares who has prices between 300 – 700.

Which Stocks To Avoid To Trade In Intraday?

Now we know what compulsory conditions you should look for in stocks before selecting it for intraday. Here are certain conditions in the stock that should not be in the stock selected for intraday trading:

- Stock With Low Volume: Stocks with low volume are not very effective in intraday trading as low volume creates fewer movements in charts within a day.

- Highly Volatile Stocks: Stocks that have extreme fluctuations are not best for intraday trading. High volatility can disrupt the effectiveness of strategies based on technical analysis.

- Stock With Unclear News: Stocks with unclear news should be avoided our handled with precision as it’s harder to predict the direction of the chart.

- Liquid Penny Stocks: Liquid stocks with low trading volume and small market capitalization should be avoided.

Some of the above conditions are best for Swing Trading, Long long-term investing and are not very useful for intraday trading.

What To Do After Picking The Stocks For Intraday Trading?

Now After Preparing stocks for intraday trading what do we have to do? What Strategies to use? How to enter ?, How much profit do we have to make? & how to exit the trade?

Let’s anwer all above questions one by one

1)Set Clear Target & Stop Loss

After know all the condition in the market & choosing best strategies according to the condition you have to set clear target & stop loss. You can use advanced techniques like trailing stop loss to increase the profit.

2) Identify Trend In The Market

To increase the wining rate of the trade always go with the trend. To identify the trend in the market you can use EMA Indicator & update it to get the last 7, 30 day moving average.

3) Go With Best Strategies For The Intraday

After identifying the trend you can use best strategies in the intraday tading like Buy High Sell Higher, Breakout strategies, Pullback strategies, Mean Reversion Trading, News-Based Trading.

4) Get the Best Technical Indicators For Making Strategies For Day Trading

There are some technical indicators that are most commanly used in the intraday trading & used to make robust strategies for intraday trading. Here are some best indicators for intraday trading:

- Volume, Relative Volume

- Moving Average

- Relative Strength Index

- Bollinger Bands

- Moving Average Convergence Divergence

- Stochastic Oscillator

- Average True Rane

- Fibonacci Retracement Levels

- Volume Weighted Average Price

7) How To Exit The Trade

After setting the clear target & stop loss their are two condition to exit the trade. First is When the trade is going in your favour Second, the trade is going to hit the stop loss.

In intraday trading when the trade is going to hit the target you can use tralling stop loss to increase the profit & when its going to hit the stop loss do not increase the pre defined stop loss.

I hope that you liked above blog post on how to choose stocks for intraday trading make sure to make your own trading system with predefined rules & strategies.