(Safe) Highest Dividend Paying Stocks Last 10 Years In India

The highest Dividend paying stocks of the last 10 years tell about the stability, growth potential, and financial strength of the company.

In this blog post, we will see the list of the Highest Dividend Paying Stocks in the last 10 Years In India. These stocks have shown constant growth and continue to give strong dividends in upcoming years.

While listing the highest dividend-paying stocks in the last 10 years we will consider the price appreciation with the appreciation of dividends to get more good dividend-paying stocks.

Investing in such highest dividend-paying stocks not only helps you to build a strong capital appreciation portfolio but also creates regular income streams as dividends.

Table of Contents

What Are Highest Dividend Paying Stocks & Its Importance?

Dividend-paying stocks are a type of stock that gives some part of the profit to the shareholder in the form of a dividend. These stocks are always the stocks of well-established & profit-making companies.

Investing in dividend-paying stocks is important because:

- They help with capital appreciation for the long term.

- Investing in such stocks keeps our investment more stable with minimum risk.

- They help to fight against inflation.

- Dividend when reinvested helps to compound our returns from the stock market.

- They help to diversify our income from the stock market.

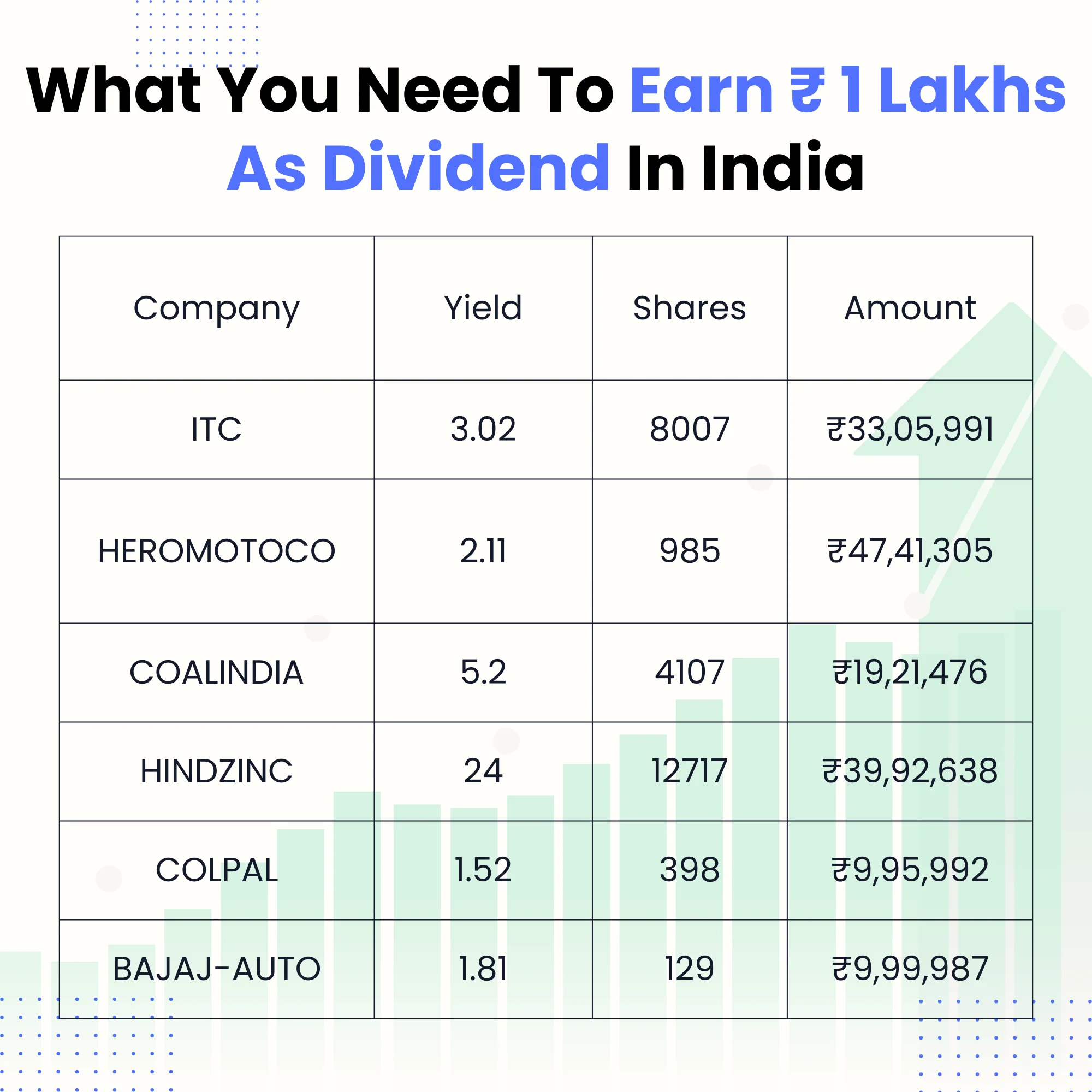

List Of Highest Dividend Paying Stocks Last 10 Years In India

Here is the list of the Highest dividend stocks Last 10 Years In India:

| Divided Paying Stocks | Sector Name | Dividend Yeild % |

| Coal India | Mining | 5.59% |

| Power Grid Corporation | Energy | 4.00% |

| Oil India | Energy | 3.33% |

| GAIL | Energy | 2.76% |

| Hindustan Zinc | Mining | 25.83% |

| ITC | Consumer Goods | 0.18% |

| Polycab India | Consumer Goods | 0.39% |

| Vedanta | Mining | 37.42% |

| IOC | Energy | 1.74% |

| ONGC | Energy | 4.20% |

| Tech Mahindra | Technology | 3.61% |

| VST Industries | Consumer Goods | 4.22% |

| Indraprastha Gas | Energy | 3.02% |

| Castrol India | Energy | 4.03% |

| Ruchira Papers | Manufacturing | 4.47% |

| Power FIN Corpn. | Finance | 2.81% |

| HCL Technologies | Technology | 3.36% |

| NHPC | Energy | 1.82% |

| Hero Motocorp | Automotive | 2.33% |

| Hindustan Global Solutions | Services | 2.03% |

What Are Factors To Consider Before Investing In Highest Dividend Stocks

Here is a list of factors that you should consider before investing in dividend stocks:

- Don’t focus on the dividend percentage instead focus on dividend yield.

Usually, we see more about the dividend percentage, which we should avoid investing in because dividend percentage is calculated by the face value of the stock. We should invest in the share by seeing the dividend yield as it is calculated on the actual share price.

- The company should have a good Dividend History (Increasing dividend growth)

The stock in which you will invest should have a good dividend history means they the dividend declared by stock should be in range or increasing year by year.

- The Company Should Have Good Financial Health which includes free cash flow, an increase in net profit, and low debt.

Many companies announces huge dividend just to attract the investor. In long run this is nor profitable, before investing in dividend stocks we should look financial factors like free cash flow, increasing net profit to grow business & they should have less debt.

- The Company should have a market cap of more than ₹ 100 CR

Companies which pays high dividend under the market cap of less than ₹ 100 Cr are not best & in the long run their will be depreciation of your investment. Before investing in stock make sure stock has market cap of more than ₹ 100 Cr plus moderate dividend yeild.

- The company should have a safe dividend yield.

Companies paying more than 4% dividend yield are not best in the long run. If a company is paying big dividend then the profit and the business growth of that company may impact.

Stocks like these are best for investors who just want dividends and aren’t interested in staying in the company long enough to gain capital appreciation

- Industry & Market Condition

Before investing in the high dividend paying stock we should see the industry & market condition in which they are working. Industry or market in which company is running should be growing with medium to high CAGR. Examples of such industry are IT, Energy, FMCG, Automotive, etc

- Tax implications

When company announce dividend to the share holders they are taxed twice. The first is on revenue, and the second is after the dividend distribution to shareholders. As a result of double taxation, there can be negative effects on a company’s potential growth in terms of profits and business.

Best Dividend Paying Stocks For Long Term (Next 10 Years)

We have seen the highest dividend-paying stocks of the last 10 years. Now we will identify the best stocks for the next 10 years that will be as good as the previous 10 years.

Best Dividend Paying Stocks For Long Term (Next 10 Years):

- ONGC

- TCS

- Vedanta

- Reliance Industries Ltd

- Devon Energy DVN.

- Adani Enterprises Ltd

- Tata Motors Ltd

- Tata Power

- Ambuja Cements

Can We Get Monthly Dividend In India?

You cannot receive monthly dividends from a single stock, but you can create a portfolio of stocks that may provide monthly dividends. Here are some stocks you can invest in to receive monthly dividends:

| Dividend Paying Stock | In Month Of |

| TCS | January |

| Balkrishna Industries | February |

| Ambuja Cements | March |

| HCL | April |

| ITC | May |

| ICIC BANK | June |

| Tata Motors | July |

| Crisil | August |

| CDSL | September |

| Hindustan Unilever | October |

| Dabur | November |

| Hindustan Zinc | December |

What Stocks Pay 3-4 Times Dividend In India?

Here is the list of stocks that pay dividends three to four times a year:

- Infosys

- TCS

- KKCL

- Godrej

- Sun Tv Network

- Indian Oil Corporation

Conclusion On Highest Dividend Paying Stocks Last 10 Years

So at the end should we invest in the highest dividend paying stocks? What are pros & cons of investing in such stocks? Are stocks which do not pay good dividend best?

Investing in highest dividend paying stocks depends upon your objectives. Some stocks pays good dividend & also grows year on year such stocks are considers best for long term.

Some stocks pay high dividend but as we go long their share price falls which cancel our the dividend paid with depreciation of share price. Such stocks are best for only dividend & not effective for the long term.

So now its upon your goals which one you want to invest. According to me you should invest in the stocks that pays dividend between 2-3% & growing year on year with net profit such stocks plays huge role in capital appreciation along with dividend income.

Related: How To Choose Stocks For Intraday Trading